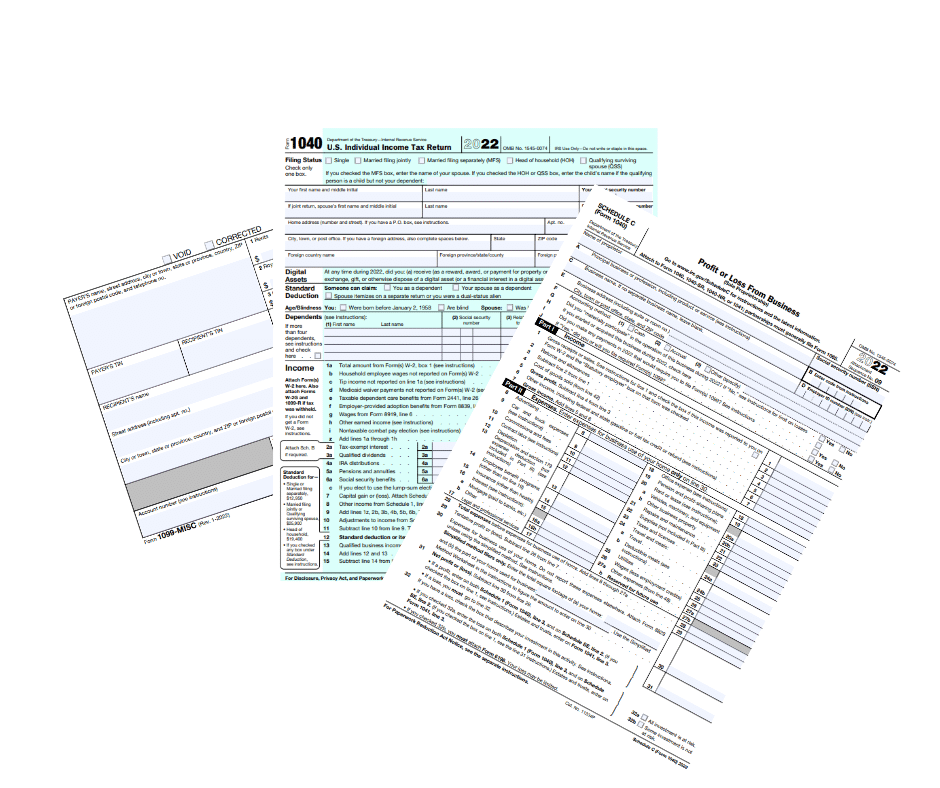

Filing your taxes can seem overwhelming, especially if you’re unsure what forms to file. Here’s a breakdown of the most common forms you’ll need to file your taxes:

Form W-2

If you’re an employee, your employer will provide you with a Form W-2, which reports your wages, tips, and other compensation. You’ll need this form to file your taxes.

Form 1099

If you received income from sources other than your employer, such as freelance work or investment income, you might receive a Form 1099. There are different types of 1099 forms, depending on your income source.

Form 1040

This is the main tax form that everyone must file. It includes a summary of your income, deductions, and any credits and payments you’ve made.

Schedule A

This form itemizes your deductions, such as charitable contributions, medical expenses, and state and local taxes.

Schedule C

If you’re self-employed, you must file a Schedule C, which reports your business income and expenses.

Schedule SE

This form calculates your self-employment tax, which is the tax you pay as a self-employed individual.

Form 8962

If you received premium tax credits to help pay for your health insurance through the Affordable Care Act, you must file Form 8962 to reconcile those credits with your income.

Remember, the forms you must file may vary depending on your situation. It’s always best to consult with a tax professional to ensure you have all the necessary documents and are filing them correctly.

If you’re looking for professional tax preparation and bookkeeping services, we’re here to help. Our team of experienced professionals can ensure you have all the necessary forms and are filing them correctly to minimize your tax liability. Contact us to schedule a consultation and learn how we can help you with all your tax and bookkeeping needs.