Nobody wants to go through an audit when filing their taxes. While audits are rare, there are steps you can take to reduce your chances of being audited. Here are some tips to help you avoid an audit when filing your taxes:

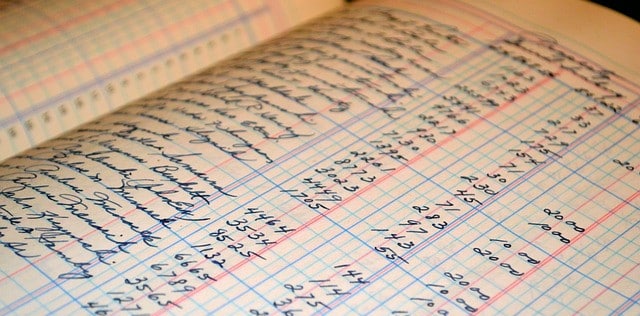

Keep Accurate Record

One of the best ways to avoid an audit is to keep accurate records of your income and expenses. Keep receipts and documentation of any deductions you plan to claim.

Be Honest

It’s essential to be truthful and honest when filing your taxes. Don’t inflate your deductions or claim expenses that are not legitimate. If you’re unsure about a deduction, consult with a tax professional.

File On Time

Filing your taxes on time can reduce your chances of being audited. Late filings can raise red flags and trigger an audit.

Use Software

Using tax software can help reduce errors and increase the accuracy of your return. Many tax software programs also include error-checking features that can help catch mistakes.

Consult With A Professional

If you’re unsure about how to file your taxes or have a complex tax situation. A tax professional can help ensure your return is accurate and reduce your chances of being audited.

Remember, while audits are rare, reducing your chances of being audited is important. Keep accurate records, be honest, file on time, use software, and consult with a professional if needed.

If you’re looking for professional tax preparation and bookkeeping services, we’re here to help. Our team of experienced professionals can help ensure your return is accurate and filed on time, reducing your chances of being audited. Contact us to schedule a consultation and learn how we can help you save time and money on your taxes this year.