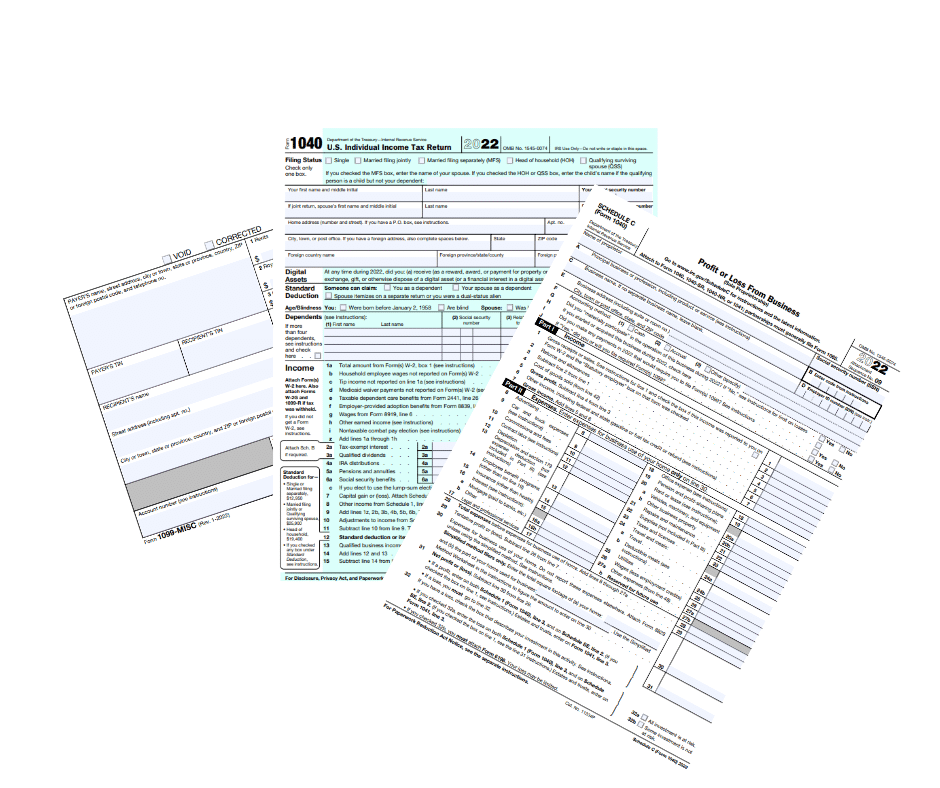

How do I know if I need to pay estimated taxes

If you’re self-employed or receive income that isn’t subject to withholding, you may need to pay estimated taxes to the IRS. Estimated taxes are payments made throughout the year to cover your tax liability, rather than waiting until the end of the year to pay in one lump sum. But how do you know if … Read more