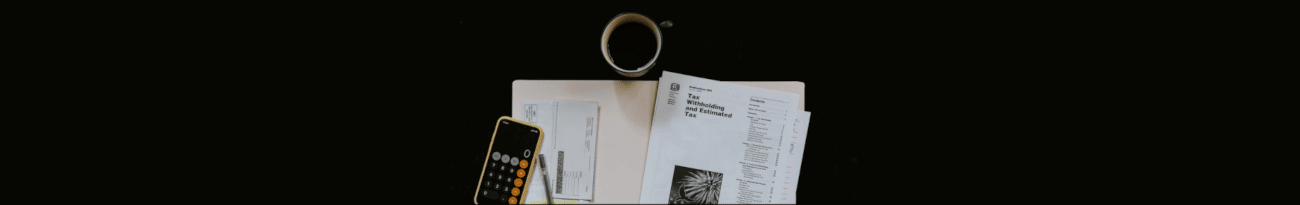

Our Tax Preparation and Planning Services can help you through the complexities that can arise from both Federal and State Income Taxes.

Proper preparation and planning can help reduce your tax liability concerning business and personal aspects.

Many people wonder at what age they need to start paying taxes, and I am here to provide that answer.

Individuals must start filing taxes as soon as they pass the income threshold, determined by their filing status. As of the tax year 2022, those thresholds are…

Single Filing Status

- $12,950 if you are under 65 years old

- $14,700 if you are 65+

Head Of Household:

- $19,400 if you are -65

- $21,150 if you are 65+

Married Filing Jointly:

- $25,900 if both spouses are -65

- $27,300 if one spouse is -65 and the other is 65+

- $28,700 if both spouses are 65+

Married Filing Separately:

- $5 for any age

Qualifying Widow(er):

- $25,900 if you are -65

- $27,300 if you are 65+